Tax Reduction Planning From Experienced CPAs

Expert Tax Planning Services

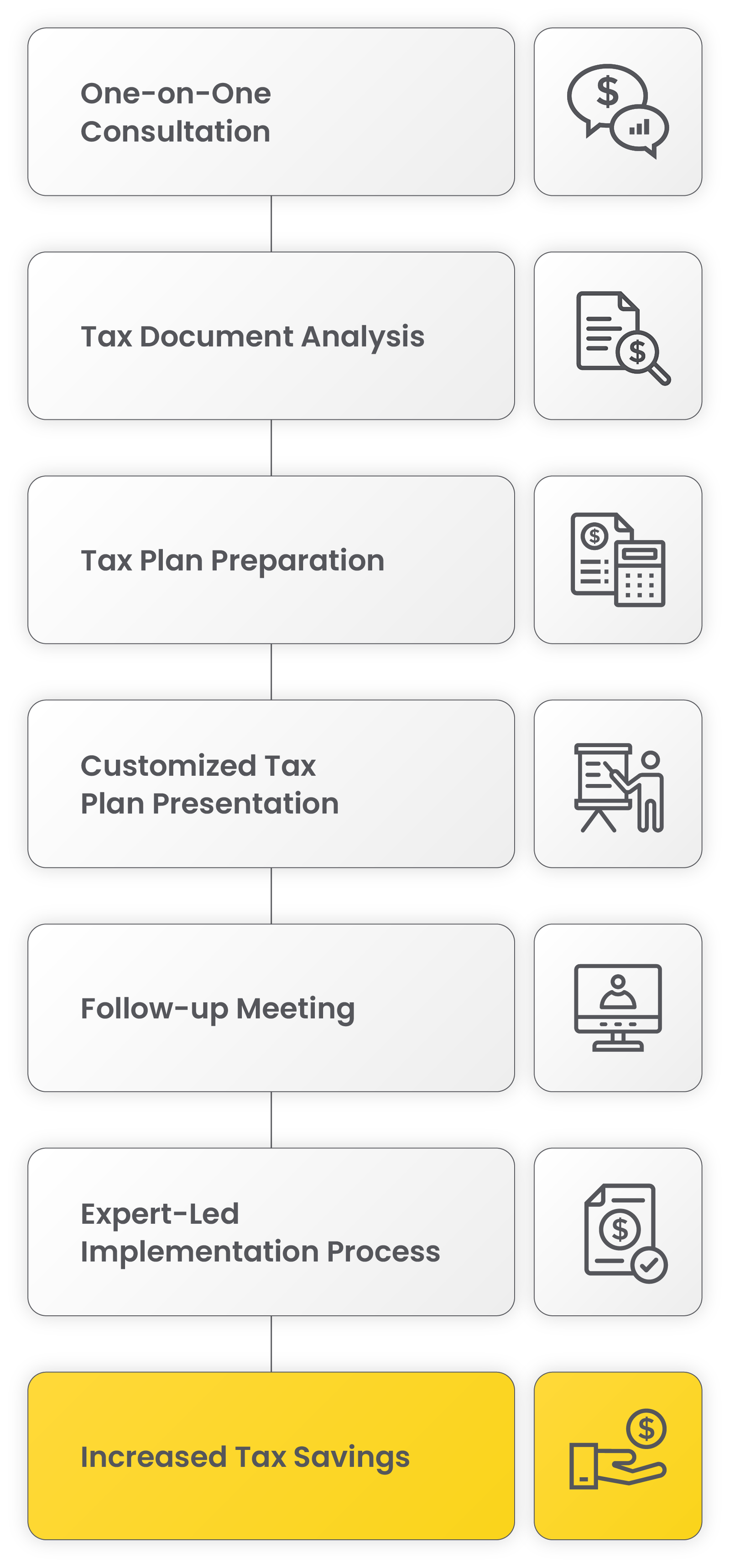

There’s a reason that tax reduction planning is our flagship consulting service for both business owners and high income individuals. By working with Ratio CPA, our clients save an average of over $57,000 in taxes on an annual basis—every year. Best of all, we can work with you even if you are already working with an accountant. Ratio CPA offers a free tax planning consultation and tax return analysis, both to business owners and high income individuals. Schedule your consultation today.

As a top-ranked tax and accounting firm, Ratio CPA puts an emphasis on our tax reduction planning services. This is the tax advisory service that will help you lower your tax burden, adds the most value, and what makes us stand out as a CPA firm.

Tax planning is a comprehensive, custom analysis of your tax structure and finances undertaken to determine strategies for lowering your tax liability. Tax planning is not income tax preparation, which is the annual preparation and submission of your income tax returns. We offer tax reduction planning services to both businesses and high income individuals.

We work with you to analyze…

- Your deductions

- Your legal entity structure

- Your retirement and insurance structures

- Business and self-employment tax reduction strategies

- Advanced tax planning strategies (e.g. R&D tax credits, Investment Tax Credits, 1031 exchanges)

- Strategies for high-income individuals, also with a W-2 as a main source of income

- Custom client requests (e.g. purchase or sale of a business, real estate strategies, capital gains, setting up college funds for young children)

- Your compliance with IRS regulations

Resulting in…

Our average client saves over $57,000 on an annual basis, totaling over $285,000 during a five-year period. That’s a nice chunk of change that can be used for a major down payment or other investment!

There is no need to change your current CPA or accountant to work with Ratio CPA, as we can limit our services to consulting on tax reduction planning. If you’re searching for a partner for your long-term financial goals, we can also take care of all your tax and accounting needs.

Business Tax Planning Strategies

When it comes to tax reduction planning for your business, it can be hard to know where to start. You’ll find a myriad of business tax planning strategies and advice columns online, but how do you know which strategies are right for you and whether these strategies are compliant with tax law? If you try to navigate tax reduction on your own, you may find yourself quickly overwhelmed in the rules, terms, tax code, and strategy implementation.

By working with Ratio CPA, you’ll have a trusted CPA on your side to review your business’s specific tax situation and recommend the right tax reduction planning strategies for your long term goals. Whether you’re self-employed or managing a medium-sized business with employees reporting to you, we can help you identify advanced tax planning strategies through our comprehensive business tax services.

Individual Tax Planning Strategies

Whether you are a W-2 income earner or receive 1099s or K-1s, we can help you decrease your income tax liability. Ratio CPA offers advanced tax reduction strategies that will directly lower your federal and state income taxes, without focusing on the usual 401(k), HSA, IRA, and real estate strategies offered by other firms.

In addition, you do not need to wait years to realize your tax savings, since you will see your income taxes lowered on your very first tax return!